The Coles and Woolworths Duopoly

What is it?

The Coles and Woolworths duopoly refers to a situation in the Australian retail grocery market where two major supermarket chains, Coles and Woolworths, dominate the industry to a significant extent. These two companies have a substantial market share and wield considerable influence over the pricing, availability, and distribution of groceries and other consumer goods in Australia.

This duopoly has been a subject of debate and scrutiny in Australia because of concerns related to competition and consumer choice. Some argue that the dominance of Coles and Woolworths can limit competition from smaller retailers and potentially lead to higher prices for consumers. Additionally, their market power can impact suppliers and producers, as they may have limited bargaining power when negotiating with these large supermarket chains.

Efforts have been made by regulatory authorities in Australia to promote competition and address concerns related to this duopoly, including measures to encourage the growth of smaller retailers and promote fair trading practices in the industry.

Humble Beginnings

In 1924, Woolworths began with one store in Sydney, later expanding to a second one three years later. They quickly adapted to meet the needs of the growing middle class and the increasing demand for supermarkets. By 1959, Woolworths had 300 stores and had become a major industry player, known for their own brands and acquisitions in various consumer sectors.

In 1993, Woolworths went public, accelerating their growth, and they remain a prominent player today.

Coles, founded in 1914, aimed to provide an honest shopping experience. Over time, they adapted to cater to working women, diversified into various industries, and prioritized altruism, supporting charities with a portion of their profits.

As years passed, Coles expanded nationwide, offering a wide range of products, and today, they’re a modern supermarket chain with a remarkable journey.

Innovations

Woolworths and Coles were both innovative companies, constantly improving the shopping experience for their customers. They introduced several key innovations:

Self-Service: In the 1950s, Woolworths pioneered self-service stores, where customers could browse and collect items themselves, a concept now common in all stores.

Sales Catalogues: Coles introduced store catalogs in the 1950s, allowing shoppers to plan their purchases from home, a novel idea at the time.

Freestanding Supermarkets: Woolworths and Coles created large, standalone supermarkets with their own parking lots, a departure from the connected stores of the past.

Inventory Tracking: Starting in the 1990s, both companies embraced barcode-based inventory tracking, automating tasks and improving data collection.

White Label Brands: Both companies developed house brands alongside vendor products, changing how mass-market goods were marketed.

Rewards Programs: Woolworths and Coles used customer data to create loyalty programs, offering value to customers while gathering data for better service.

These innovations, while commonplace today, were groundbreaking in their time, helping Woolworths and Coles maintain their dominance in the market.

the Price of Competition

In the world of supermarkets, there’s limited room for product differences. Woolworths and Coles had access to the same suppliers due to the global supply chain, so they mainly competed on price.

Since neither company manufactured their own products, they had two main ways to lower costs significantly: reduce overhead expenses or negotiate lower prices with suppliers.

Both companies aimed to maintain the quality of their in-store experience, so they were cautious about cutting overhead costs. They also valued their employees and didn’t want to reduce salaries. While some technological advancements helped, they primarily needed to address input costs.

This led to a price competition between Woolworths and Coles. They constantly negotiated with suppliers to lower costs and pass the savings on to consumers. When one company secured a discount from a supplier, the other tried to match it. Similarly, if one company negotiated better payment terms with a distributor, the other quickly followed suit.

This relentless focus on lower prices put significant pressure on suppliers. However, suppliers had limited bargaining power because these supermarket chains represented a substantial portion of their sales. Being associated with Woolworths or Coles was an opportunity they couldn’t easily refuse. As a result, these corporations gradually reduced prices, using each other as leverage along the way.

The Woolworths-Coles Duopoly: Impact and Controversy

The duopoly held by Woolworths and Coles has sparked controversy in the Australian market, especially regarding its impact on newcomers attempting to enter the market, often with unsuccessful results. As discussed earlier, both giants leveraged their substantial size and influence to drive prices down to a level that poses a significant challenge for competitors lacking a comparable infrastructure.

Emerging chains face a daunting hurdle in achieving the same low prices as the two industry giants. They lack the purchasing power and brand reputation enjoyed by Woolworths and Coles. Consequently, there exists an insurmountable entry barrier as long as Woolworths and Coles maintain their market control.

Debates on this issue have two sides. Some argue that those complaining are simply unable to compete and assert that this is the essence of a free market. They contend that low prices benefit consumers, which is the ultimate goal.

However, this perspective overlooks a crucial nuance. Society regulates competition to encourage a diversity of choices and prevent power from consolidating in the hands of a few dominant market players. When corporations become so immense that they completely dominate a market, it hampers the emergence of new players and weakens the overall market’s resilience.

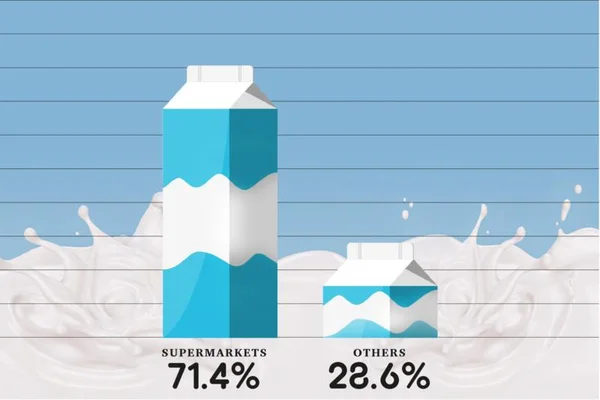

It resembles the milk situation we’ve seen before. Are we willing to tolerate an unstable economic system for short-term cost savings? Many say no, but determining the appropriate regulations, if any, remains a complex challenge.

What’s evident is that the duopoly may have stifled the growth of the supermarket industry in Australia, limiting opportunities for new entrants and further cementing the incumbents’ positions.

Nevertheless, there are glimmers of hope for a positive outcome. The public discourse surrounding this issue is likely to prompt Woolworths and Coles to think carefully about any future acquisitions. It’s unlikely they’ll have the same freedom to acquire smaller players as they have in the past, potentially allowing independent grocers room to expand.

Another promising aspect is the ongoing shift toward online shopping, accelerated by the COVID-19 pandemic. This digital transformation opens up new avenues for competition, where players no longer require massive retail stores or an established brand to attract customers. It presents fresh opportunities that should inspire new entrepreneurs and compel incumbents to adapt.

Only time will reveal whether the duopoly can be disrupted, but one thing is certain: the competition between Woolworths and Coles will persist, regardless of the macro-level outcomes.

Key Takeaway: Growing too large can lead to complications and challenges. Caution must be exercised when establishing monopolies or duopolies, as these can draw regulatory scrutiny. Strategic acquisitions should be made with careful consideration of their broader societal impacts.

“Australian farmer says Woolworths and Coles $1 milk is hurting them worse than the drought.”

How the Duopoly Hurts Farmers

A new report criticizes the supermarket industry, saying that Coles and Woolworths’ strong presence harms the wider agriculture and food sector.

The report, called “The Need for Strategic Food Policy in Australia” by the Commission for the Human Future, points out that most of Australia’s food system is focused on serving just a few companies. Coles and Woolworths, in particular, dominate with about 60% of fresh food and grocery sales.

“A food system that depends on a few corporate interests creates perverse outcomes, particularly the squeezing of producers and processors’ margins,” the report said.

The Coles and Woolworths duopoly in the Australian supermarket industry has been a source of concern for many farmers and agricultural producers. Here’s how it can negatively impact them:

Price Squeezing: Coles and Woolworths, as dominant players in the market, have significant bargaining power when dealing with suppliers, including farmers. They often negotiate hard for lower prices for the products they purchase from these suppliers. This price squeezing can lead to reduced profitability for farmers, making it challenging for them to cover their production costs and invest in their operations.

Limited Market Access: The duopoly’s immense control over the supermarket sector means that they can dictate which products they choose to stock on their shelves. As a result, many farmers are reliant on these two retailers as their primary market outlets. If Coles and Woolworths decide not to stock a particular product or offer it at unfavorable terms, it can severely limit a farmer’s ability to sell their goods, forcing them to comply with the retailers’ demands.

High Standards and Requirements: To meet the stringent quality and packaging standards imposed by Coles and Woolworths, farmers may need to make costly adjustments to their production processes. These standards often involve specific packaging, labeling, and quality criteria that may not be financially viable for smaller or less-established farmers. Complying with these requirements can put additional financial strain on producers.

Volatile Pricing: The duopoly’s aggressive pricing strategies, such as deep discounts and promotions, can lead to fluctuating prices for agricultural products. This price volatility can make it challenging for farmers to predict their income and plan for the future, creating financial instability.

Limited Choice: The dominance of Coles and Woolworths can limit the variety of products available to consumers. While they offer a wide range of products, the emphasis is often on mass-market, highly standardized items. This can be detrimental to smaller or niche producers who struggle to find a place on the shelves of these supermarkets.

Negotiation Imbalance: Negotiating with two powerful supermarket chains can leave farmers with limited leverage. They may be hesitant to demand better terms or higher prices for fear of losing access to these crucial markets.

Costly Promotions: While promotions and discounts can benefit consumers, they often place a significant financial burden on suppliers. Farmers may be asked to subsidize these promotions, reducing their profits further.

In summary, the Coles and Woolworths duopoly in the Australian supermarket industry can hurt farmers by driving down prices, limiting market access, imposing strict standards, creating price volatility, reducing product variety, and creating an imbalance in negotiations. Farmers often find themselves in a challenging position, trying to meet the demands of these major retailers while maintaining the viability of their operations.

Dairy producers face challenges in maintaining their profitability.

Australian dairy farmers, known for their efficiency and best practices, struggle to stay profitable due to unpredictable international prices that often fall below their production costs. Processors and supermarkets have significant influence in the supply chain, often keeping most of the profits.

Australian dairy farms have shifted toward larger herd sizes (averaging 300 cows) to benefit from economies of scale, unlike many other countries with smaller herds (often less than 150 cows).

Dairy farmers in Australia are also adopting cost-saving technologies, such as rooftop solar panels and biomass generators, at a leading global rate.

Despite these efforts, dairy farming is becoming less viable in many parts of Victoria. Negotiations between processors, manufacturers, and supermarkets rarely result in real benefits for the farmers.

As highlighted in a submission by NSW Farmers to the Australian Competition and Consumer Commission (ACCC) Dairy Inquiry, consistently low farmgate milk prices could weaken farmers’ financial resilience, especially during extreme weather conditions and costly input cycles involving energy, water, and feed. NSW Farmers cautioned that this reduced resilience might ultimately lead to potential shortages of dairy products for consumers. However, the ACCC inquiry disregarded these concerns.

In April 2019, consumers in NSW experienced shortages of dairy products as supermarkets struggled to meet demand. Lion, one of Australia’s major dairy processors, acknowledged that “Extreme weather conditions… along with significant cost increases in water, feed, and energy” had contributed to the challenges faced by the dairy industry in Australia, resulting in reduced milk supply.

Who owns Coles?

It is not commonly known that Wesfarmers merged with Coles. And who is the top shareholder of Wesfarmers? Yep, you guessed it, Black Rock, Inc. And The Vanguard Group, Inc.

The potential negatives associated with the company BlackRock include:

Size and Influence: BlackRock is one of the largest asset management companies globally, which can lead to concerns about its influence on financial markets and its ability to affect investment decisions on a broad scale.

Systemic Risk: Due to its sheer size, BlackRock’s activities can have a significant impact on the financial system. Critics argue that its size can make it “too big to fail,” which could potentially result in taxpayer bailouts in the event of a financial crisis.

Conflict of Interest: Some critics argue that BlackRock may have conflicts of interest, as it both manages assets and provides advisory services. This dual role may raise questions about whether the company prioritizes its own financial interests over those of its clients.

Environmental Concerns: BlackRock has faced criticism for its investments in companies associated with fossil fuels and other environmentally damaging industries. Some argue that the company should do more to promote sustainable and responsible investing.

Lack of Transparency: Like many financial institutions, BlackRock has been criticized for its lack of transparency in certain aspects of its operations, including its voting and engagement practices in relation to shareholder resolutions.

Market Concentration: BlackRock’s dominance in the asset management industry has led to concerns about market concentration. Some worry that this concentration could stifle competition and limit choice for investors.

Regulatory Scrutiny: As a major player in the financial industry, BlackRock is subject to regulatory scrutiny. Any regulatory changes or investigations could have implications for the company’s operations.

It’s important to note that opinions on these negatives may vary, and BlackRock also has many supporters who emphasize its role in providing diversified investment opportunities and financial services to clients. Additionally, the company has made efforts to address some of these concerns through initiatives focused on sustainability and transparency.

About the Author

Mr Stacky is the leader in Tower Garden Systems in Australia, specializing in commercial hydroponic farming, urban farming & residential vertical gardening.

Find out how he can help you achieve your food production goals. Contact Brian